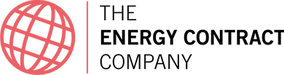

After a year in which gas (and electricity) prices have soared to unimaginable heights, they have recently declined to much more moderate levels. On 10 th March NBP Day ahead prices were down to 110p/therm, compared to 355p, a year previously. Figure 1 shows NBP and TTF prices from October 2021 to February 2023. It shows the remarkable recent decline from the peaks reached in Q3 2022.

Figure 1. TTF and NBP Day Ahead prices, October 2021 to February 2023 in p/therm

Many commentators have interpreted this decline to mean that the menace of high energy prices has now receded. Sadly, this may not be the case, at least for the next few years. There have been a number of special circumstances underlying the recent price falls, which may well not be repeated.

1. Chief amongst these is the weather.

a. Gas demand is an inverse function of temperature and virtually all of Europe has had a very mild winter. As a result, European gas demand has been below expected levels.

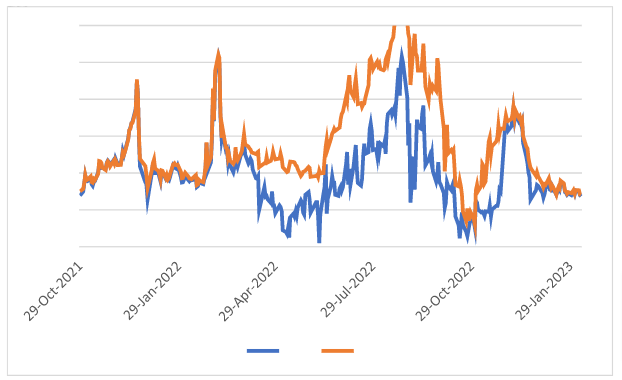

b. It has also been a very mild winter in the Far East, which has reduced demand for LNG worldwide and led to lower prices for spot cargoes. As a result, JKM Spot LNG prices for deliveries in the Far East fell from $53/mmbtu in October 2022 to $18 for March 2023. JKM prices from Mid 2021 to March 2023 are shown in table 2 below.

Figure 2. JKM LNG Spot Cargo prices July 2021 to March 2023 in $/mmbtu

c. After some very cold weather in North America in December it has also been mild there in Q1. Henry Hub prices have fallen from a peak of $9/mmbtu in Mid June 2022 to $2.6/mmbtu currently.

2. The other key driver in recent months has been the relatively low level of LNG demand in China. In 2022 it was only 87 bcm, a decline of 21% compared to 2021. This was caused by a combination of demand destruction due to high prices, covid restrictions, switching back to coal for generation and slowing economic growth. This decline allowed Europe to pick up the extra cargoes it needed. The outlook for this year is rather uncertain and the IEA suggest a very wide range of LNG Demand in China for 2023 of 75 to 115 bcm.

3. The significance of LNG is that, with rapid decline in Russian gas exports to Europe, LNG has now overtaken Russia as the chief source of gas for Europe. If the World LNG market comes under stress, then prices will rise again in Europe, perhaps significantly.

In the longer term the current tightness in the LNG market will gradually ease as more LNG liquefaction comes onstream. Around 45 bcm of new capacity took FID in 2021 and around 35 bcm in 2022. Project approvals in 2023 should amount to around 65 bcm. By 2027 the world LNG market should look much better supplied, with LNG supply capacity rising from 520 bcm/year to around 720 in 2027.

However, the period up to the end of 2026 remains potentially very difficult. The relatively benign market conditions we have seen over the last six months may not be repeated. In particular the potential surge in Chinese LNG buying poses a significant risk to gas markets in Europe. There is still a very real risk that prices could spike again dramatically at any point in the next 3-4 years.